If you buy a voucher and then use the voucher to obtain something that is a taxable supply to you, youre entitled to claim a GST credit if that purchase is used in your business. However, youre not entitled to claim a GST credit for that purchase if it either: relates to making input taxed sales; is of a private or domestic nature.

If you buy a voucher and then use the voucher to obtain something that is a taxable supply to you, youre entitled to claim a GST credit if that purchase is used in your business. However, youre not entitled to claim a GST credit for that purchase if it either: relates to making input taxed sales; is of a private or domestic nature.

The term ‘voucher’ is defined for GST purposes as: ‘any … voucher, token, stamp, coupon or similar article … the redemption of which in accordance with its terms entitles the holder to receive supplies in accordance with its terms …’.

The term ‘voucher’ is defined for GST purposes as: ‘any … voucher, token, stamp, coupon or similar article … the redemption of which in accordance with its terms entitles the holder to receive supplies in accordance with its terms …’.

GST for gift vouchers on unknown or ‘mixed supply’ items. If the gift voucher is not for a ‘specified supply’ product or service, your reporting and payment of GST for the sale of gift vouchers should take place when the voucher is redeemed by the customer.

GST for gift vouchers on unknown or ‘mixed supply’ items. If the gift voucher is not for a ‘specified supply’ product or service, your reporting and payment of GST for the sale of gift vouchers should take place when the voucher is redeemed by the customer.

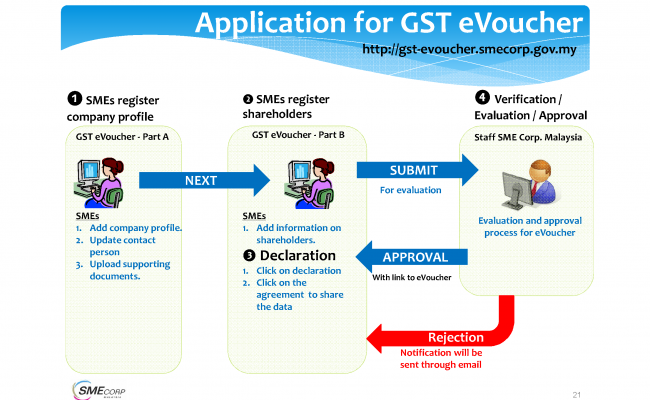

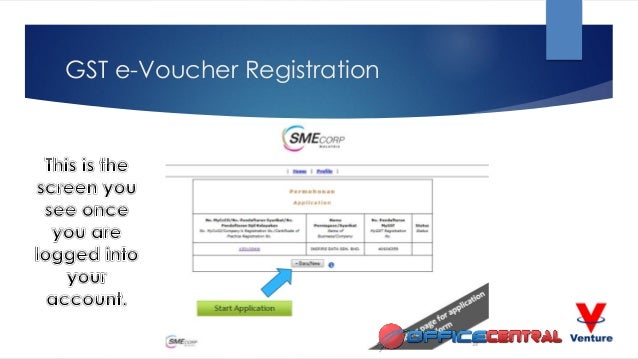

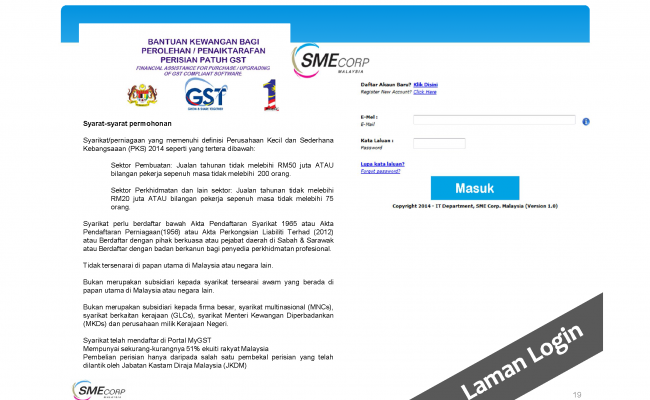

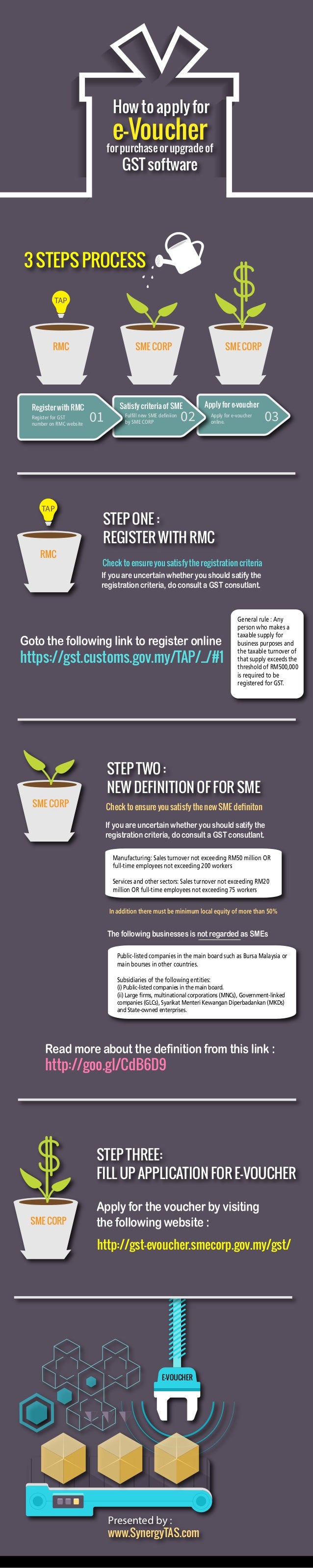

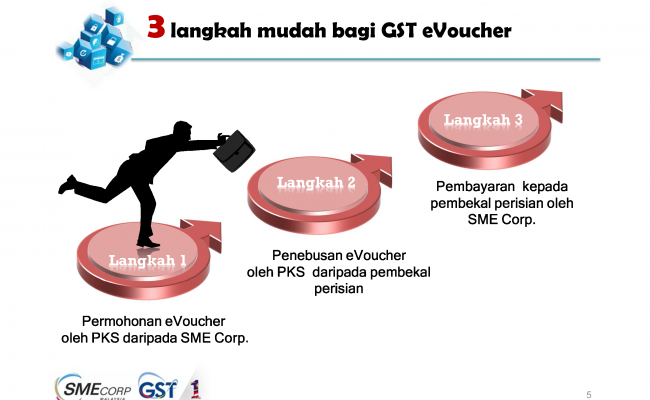

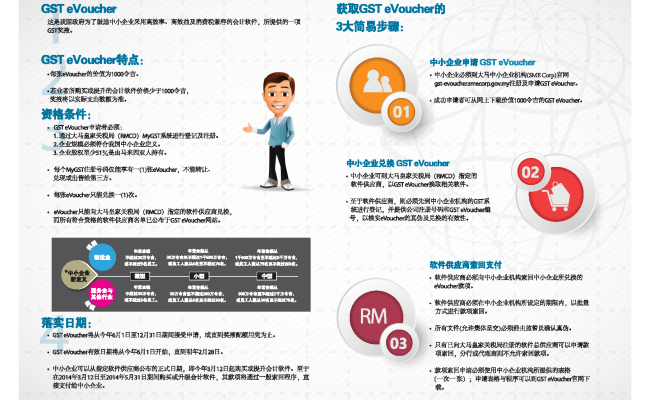

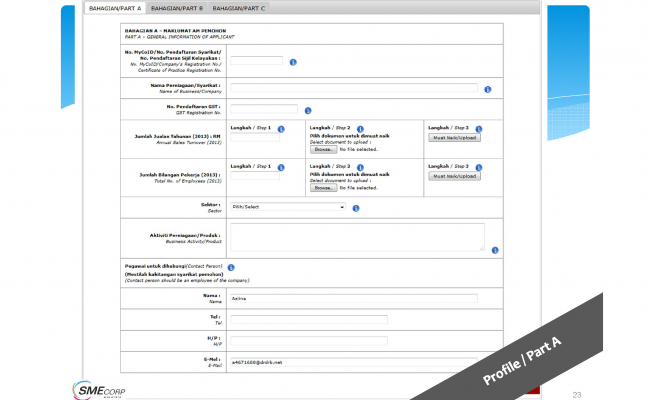

FREE E-VOUCHER DISTRIBUTION TO GST REGISTERED SMALL AND MEDIUM ENTERPRISES Please be informed that the application for the E - voucher of SME Corp Malaysia by the Small and Medium Enterprises (SME) will expire on the 10th. November 2014 at 12.00midnight. After this date, all GST registered persons will be given the E - Voucher worth RM1, 000

FREE E-VOUCHER DISTRIBUTION TO GST REGISTERED SMALL AND MEDIUM ENTERPRISES Please be informed that the application for the E - voucher of SME Corp Malaysia by the Small and Medium Enterprises (SME) will expire on the 10th. November 2014 at 12.00midnight. After this date, all GST registered persons will be given the E - Voucher worth RM1, 000

The permanent GST Voucher scheme was introduced by the Government in Budget 2012 to help lower-income Singaporeans.

The permanent GST Voucher scheme was introduced by the Government in Budget 2012 to help lower-income Singaporeans.

GST Invoices and Vouchers 1.Tax Invoice. It is mandatory for every person registered under the GST to issue a tax invoice for all supplies effected. A tax invoice is an invoice issued for the supply of taxable goods or services made to B2B and B2C clients. It is also issued while making inter-state stock transfers.

GST Invoices and Vouchers 1.Tax Invoice. It is mandatory for every person registered under the GST to issue a tax invoice for all supplies effected. A tax invoice is an invoice issued for the supply of taxable goods or services made to B2B and B2C clients. It is also issued while making inter-state stock transfers.

A voucher is considered an MRV for GST purposes if it meets all of the following conditions: The voucher is sold for a consideration (e.g. sum of money). The voucher gives a right to receive goods and services up to the value stated on or recorded in the voucher. The voucher must be presented or utilised to exchange for the goods and services acquired.

A voucher is considered an MRV for GST purposes if it meets all of the following conditions: The voucher is sold for a consideration (e.g. sum of money). The voucher gives a right to receive goods and services up to the value stated on or recorded in the voucher. The voucher must be presented or utilised to exchange for the goods and services acquired.

Remittance voucher - business tax payments. For your GST/HST, payroll and corporation remittance vouchers. Account number (BN): Every remittance voucher has an Account number box for the CRA business number (BN). If you use a non-personalized remittance voucher, enter the full 15 digits of your CRA business number.

Remittance voucher - business tax payments. For your GST/HST, payroll and corporation remittance vouchers. Account number (BN): Every remittance voucher has an Account number box for the CRA business number (BN). If you use a non-personalized remittance voucher, enter the full 15 digits of your CRA business number.

For example, a voucher which entitles the user to download only e-books from the merchant’s website will be an SPV, whereas a voucher which entitles the user to buy physical books and download e-books may be an MPV, as books and e-books are subject to different rates of GST.

For example, a voucher which entitles the user to download only e-books from the merchant’s website will be an SPV, whereas a voucher which entitles the user to buy physical books and download e-books may be an MPV, as books and e-books are subject to different rates of GST.

Citizens who are eligible and have signed up for a previous Government payment (e.g. the 2018 GST Voucher, Growth Dividend or GST Credits) will receive their GST Voucher – Cash on 1 August 2019. If you have not signed up previously , you will need to Sign Up . The deadline to sign up for the 2019 GST Voucher is 31 December 2019.

Citizens who are eligible and have signed up for a previous Government payment (e.g. the 2018 GST Voucher, Growth Dividend or GST Credits) will receive their GST Voucher – Cash on 1 August 2019. If you have not signed up previously , you will need to Sign Up . The deadline to sign up for the 2019 GST Voucher is 31 December 2019.